Dividend policy means a policy to determine what proportion of earning is paid to shareholders by way of dividend and what proportion is retained in the firm for reinvestment purposes. It is an integral part of the firm’s financing decisions. A major aspect of the dividend policy of the firm is to determine the appropriate allocation of profits between dividend payments and additions to the firm’s retained earnings.

Types of Dividend Policy

A dividend policy is crucial for every company. The firm’s dividend policy must be formulated with two basic objectives in mind: providing for enough financing and maximizing the wealth of the firm’s owners. Four of the more commonly used dividend policies are described in the following diagram.

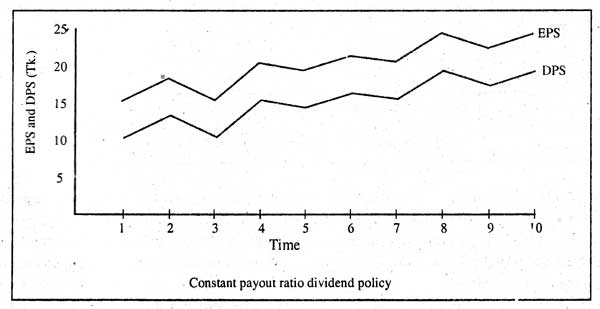

Constant Payout Ratio Dividend Policy:

The dividend payout ratio indicates the percentage of each taka earned that is distributed to the owners in the form of cash. It is calculated by dividing annual cash dividends by annual earnings; alternatively, dividends per share are divided by earnings per share. According to Lawrence J. Gitman, “Constant payout ratio dividend policy is a dividend policy based on the payment of a certain percentage of earnings to owners in each dividend period.”

In this policy, a constant percentage of earnings is distributed to the shareholder as a dividend. If earnings will fluctuate, this policy would mean that the taka mount of dividends would vary. For example, if the constant payout ratio is 30% and divisible income Tk. 1,000, then the amount of dividend will be 1000 × 30% = Tk. 300. Again if divisible income is Tk. 3,000 that the amount of dividend would be Tk. 3,000 × 30% = 900. For more clarification, it is shown in the Constant Payout ratio Dividend Policy Graph Below.

The problem with this policy is that if the firm’s earnings drop or if a loss occurs in the given period, the dividends may be low or even nonexistent. Because dividends are often considered an indicator of the firm’s future condition and status, the firm’s stock price may be adverse by affected. Although some firms use a constant-payout ratio dividend policy, it is not recommended.

Residual dividend policy:

The word residual means “Leftover” and the residual policy implies that dividends should be paid only out to “Left Over” earnings. This fact has led to the development of a residual dividend policy which state that a firm should follow these step when deciding how much earning should be paid out as dividends: (i) determine the optimal capital budget for the year (ii) determine the amount of the capital needed to finance that budget (iii) use retained earnings to supply the equity component to the extent possible and (iv) pay divided only if more earning are available than are needed to support the optimal capital budget.

The basic of the residual policy is the fact that the investors prefer to have the firm retain and reinvest earnings rather than pay them out individually if the rate. If the return the firm can earn on reinvestment earnings exceeds the rate of investor on average, can themselves obtain on other investments of comparable risk? In this policy, the shareholders are uncertain to receive dividends regularly. As a result there may be un-satisfaction among the shareholders.

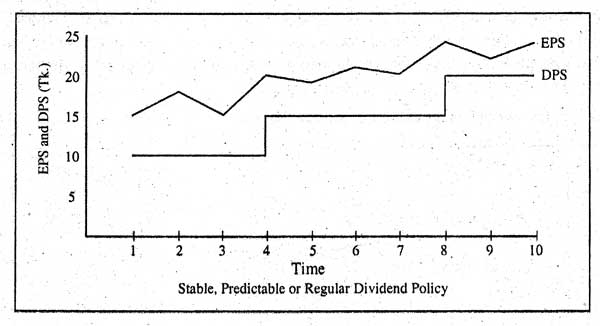

Stable, Predictable dividend policy or regular dividend policy:

The regular dividend policy is based on the payment of fixed taka dividend in each period. This policy provides the owners with generally positive information, thereby minimizing their uncertainly. Often, firms that use this policy increase the regular dividend once a proven increase in earning has occurred. Under the policy, dividends are almost never decreased.

There are two good reasons for paying stable, predictable dividends first given the existence of the information content or signaling idea, a fluctuation policy would lead to greater uncertainly, hence to higher cost of capital and lower stock price, that would exist under a stable policy. Second many shareholders use dividends for current consumption. And they would be put to trouble and expense if they had to sell part of their shares to obtain cash if the company cut the dividends. But as a rule stable predictable dividends are simply more certain than variable dividends, thus a lower cost of capital and a higher firm value. So it is this dividend policy most firms favor.

Payment of a specific amount of dividend each year or periodically increasing the dividend at a constant rate its clearly understand by Figure below:

Low regular and extra dividend policy:

A policy of paying a low regular dividend plus a year-end extra in good years is a compromise between a stable dividend and a constant payout rate. Such a policy gives the firm flexibility, yet investors can count on receiving at least a minimum dividend. Therefore, if a firm’s earnings and cash flows are quite volatile, this policy might be its best choice.

The management can set a relatively low regular dividend-low enough so that it can be maintained even in low-profit years or in years when a considerable amount of retained earnings is needed for investments and then supplement it with an extra dividend in years when excess funds are available.

In a nutshell, according to this policy, the element of total dividends are two- (i) Low fixed amount of dividend (ii) Extra dividend. When the company earns normal income, paid the low fixed amount of dividend plus extra dividend. As a result, the shareholders get confidence and they are free from any false assurance. Generally, the company whose earnings fluctuate in cycle order follows this type of dividend policy.

Which Dividend Policy is the Best?

There are different opinions relating to the questions-which dividend policy is the best. However, most of the options are in favor of stable dividend policy. For the following advantage of stable dividend policy, it is considered as the best policy:

Resolution of uncertain:

According to a stable dividend policy, the shareholders are paid a Fixed-Taka dividend in each period. This policy provides the owners with generally positive information, thereby minimizing their uncertainty. Often, firms that use this policy the shareholders usually remain in uncertainty.

Desire for current income:

There are so many shareholders who lead their lives with dividend income. They like most the stable dividend policy. Because this policy gives certainty to them.

Institutional investors’ requirements:

Any company or any institute can purchase shares of a company. For example, ICB purchase shares of different companies. The above institution invests their money by purchasing shares of those companies that stable dividends regularly. Because they want to obtain a certainly of a fixed amount.

Raising additional finances:

The stable dividend policy plays an important role in raising additional finances. Since this policy provides certainty to pay a fixed-taka dividend regularly, the prospective investors will be interested to invest their money by purchasing new shares of the company. As a result, the company can raise additional finance easily by issuing new shares.

This is a useful article. I can enrich my knowledge by reading this.

Your idea is actually outstanding. Thank’s toshare withe us such an important matter.

Best regards,

Mead Valenzuela

Founded throughout 2003, Bangladesh Sociological World is an association involving

sociologists from Bangladesh founded for the campaign involving sociological educating, study and e book throughout

Bangladesh. The most important purposeful of the Modern culture will be,